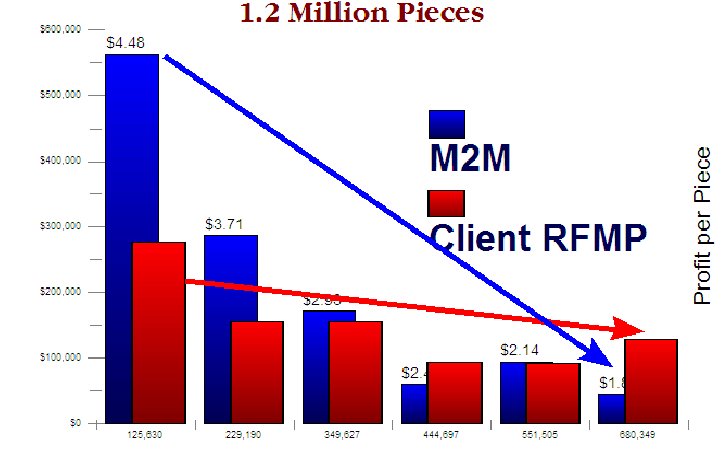

The principal obstacle to effective database marketing is the development of profitable strategies for use of the database. It is relatively easy to construct a workable marketing database. Many service bureaus are experienced at this work and can do a very satisfactory job. What the service bureau normally cannot help you with, however, is figuring out how to make your database pay off. These strategies you will have to work out yourself.

One of the oldest, and still one of the best techniques, is Recency, Frequency, Monetary (RFM) Analysis. Using this method, any marketer with a large customer database can almost guarantee profitable promotions to his customer base time after time after time. This article explains how to code your database for RFM, the theory underlying it, and some practical examples of how to make it actually pay off.

Continue reading “Making Your Database Pay Off Using Recency Frequency and Monetary Analysis by Arthur Middleton Hughes”