By Prasad Nehe LinkedIn

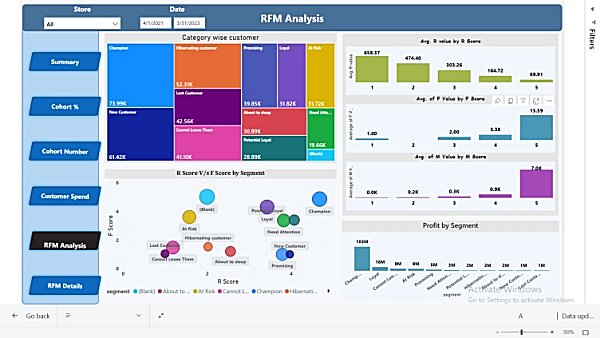

RFM analysis is a technique used in marketing and customer analytics to segment customers based on their past purchasing behavior. RFM stands for Recency, Frequency, and Monetary value, which are three key metrics used to evaluate customer engagement and profitability. Here’s how RFM analysis works and its use in marketing:

1. Recency (R): Recency refers to the time since a customer’s last purchase. Customers who have made recent purchases are generally considered more engaged and likely to make additional purchases.

2. Frequency (F): Frequency measures how often a customer makes purchases within a specific timeframe. Customers who make frequent purchases demonstrate higher loyalty and engagement with the brand.

3. Monetary Value (M): Monetary value represents the amount of money a customer has spent on purchases. High-value customers contribute more to the revenue and profitability of a business.

By analyzing these three metrics, RFM analysis helps classify customers into distinct segments, allowing marketers to tailor their marketing strategies and initiatives. Here are some common use cases of RFM analysis in marketing and customer analytics:

1. Customer Segmentation: RFM analysis allows marketers to segment their customer base into different groups based on their RFM scores. For example, “Champions” may represent customers with high scores in all three categories, indicating they are highly engaged, loyal, and valuable. Other segments may include “At Risk” customers who haven’t made a purchase in a long time, “New Customers” who recently made their first purchase.

2. Targeted Marketing Campaigns: Once customers are segmented based on RFM analysis, marketers can create targeted marketing campaigns tailored to each segment. For example, they can design reactivation campaigns to re-engage “At Risk” customers, loyalty programs to reward and retain “Champions,” or personalized offers to upsell or cross-sell to specific segments.

3. Customer Lifetime Value (CLV) Prediction: RFM analysis provides insights into customer behavior and purchasing patterns, allowing marketers to estimate the customer lifetime value. By understanding the value and engagement level of different customer segments, businesses can allocate resources more effectively and prioritize efforts to acquire and retain high-value customers.

4. Product Recommendations: RFM analysis can also be used to generate personalized product recommendations. By understanding a customer’s past purchasing behavior, marketers can recommend products that align with their preferences, increase cross-selling opportunities, and enhance the overall customer experience.

5. Churn Prediction: RFM analysis can help identify customers who are at risk of churn (i.e., discontinuing their relationship with the brand). By monitoring changes in RFM scores over time, businesses can proactively target and engage customers who show signs of decreased engagement, offering incentives or personalized interventions to prevent churn.

RFM analysis provides a data-driven approach to segmenting and understanding customer behavior, allowing marketers to make informed decisions, optimize marketing efforts, and enhance customer satisfaction and loyalty.

#RFM #customer_analytics #customer_behaviour_analysis #retail_analytics #progrmatic_marketing